Amazon Inc, the world’s largest online retailer, is being known these days as more of a technology company, and rightly so.

Technology is at the core of whatever Amazon does — from algorithms that forecast demand and place orders from brands, and robots that sort and pack items in warehouses to drones that will soon drop packages off at homes.

At its new Go Stores, for instance, advances in computer vision have made it possible to identify the people walking in and what products they pick up, helping add them to their online shopping carts.

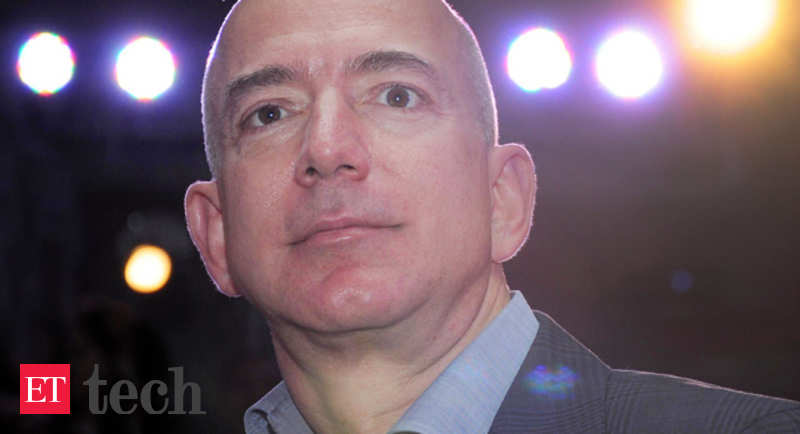

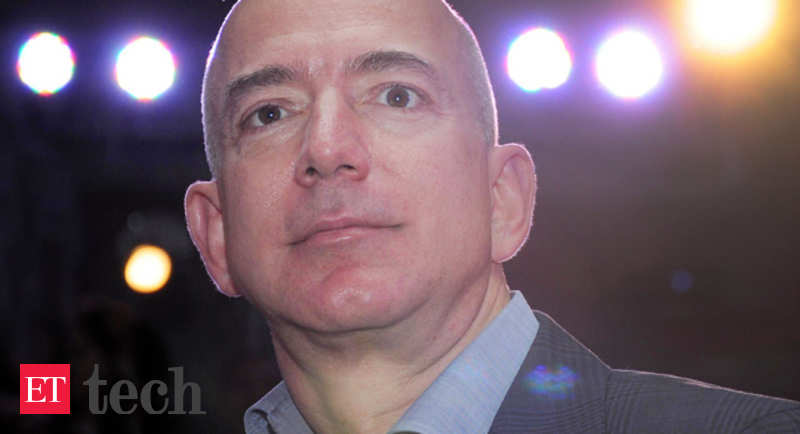

Jeff Bezos, the founder of Amazon and the world’s richest man, is always pulling new rabbits out of his hat, like next-day or same-day shipping and cashier-less stores. Besides, there is Blue Origin, the aerospace company privately owned by Bezos, which is on a mission to make spaceflight possible for everyone.

Be that as it may, a lot more disruption aimed at reaching the common man is on the anvil.

The most far-reaching and impactful technologies being developed today are for Amazon’s own use, but some others have the potential to disrupt every sector.

The technology marvels that Amazon Web Services — the largest profit driving unit in Bezos’ stable — is working on could jolt several industries, including in India, in the same way that Amazon once disrupted retail.

“In retail, while things like the size of the catalogue, advertising and other stuff might play a role in success, at Amazon, I think success is largely technology driven,” said Chief Technology Officer Werner Vogels.

The ecommerce giant is using advances in technology to disrupt several sectors outside of retail though — medicine, banking, logistics, robotics, agriculture and much more. Interestingly, some of that work is happening in India.

Initially, the thinking was around allowing enterprises in these sectors to grow by using its cloud storage and computing capabilities.

Now, Amazon’s reach has become more nuanced and it has moved up the value chain.

For example, no longer is Amazon offering banks a place to securely store information, it is going beyond by offering tools to detect fraud, making it unnecessary for the lenders to build expensive data science teams in-house.

It is a similar story in other industries, made possible due to the massive amounts of data that Amazon collects and processes.

“We give people the software capability, so they no longer need to worry about that side of things. Most of our services are machine learning under the covers (and) that’s possible mostly because there’s so much data available for us to do that,” Vogels said.

Medicine

Hospitals in the United States have to save imaging reports for years. Earlier these were stored on tapes, since doing so digitally cost millions of dollars.

The advent of cheaper cloud storage meant new scans could be saved digitally, making them accessible to doctors on demand.

Now, doctors could refer to a patient’s earlier CT scan and compare that with the new one to diagnose an ailment, said Shez Partovi, worldwide lead for healthcare, life sciences, genomics, medical devices and agri-tech at Amazon.

The power of cloud and AWS’ own capabilities in medical technology have only expanded since.

Healthcare and life sciences form rapidly scaling units of AWS, which is building a suite of tools that allow breakthroughs in medicine — from hospitals using the tools to do process modelling or operational forecasting, refining the selection of candidate drugs for trial or delivering diagnoses through computer imaging.

Developed markets will be the first to adopt such technologies, but AWS is seeing demand surge from the developing world, including India.

“Not everyone is within a mile of a radiologist or physician, so diagnostics through AI could solve for that. Further, there’s a lack of highly trained people, but when all you have to do is take an image, it requires a lot less training,” said Partovi.

Space

Bezos, in his private capacity, is now looking to connect remote regions with high-speed broadband. He is building a network of over 3,000 satellites through “Project Kuiper”, which will compete with Elon Musk’s SpaceX and Airbus-backed OneWeb.

The bigger bet is in outer space though. His rocket company Blue Origin has already done commercial payloads on New Shepard, the reusable rocket that competes with SpaceX’s Falcon 9. The capsule atop the New Shepard can carry six passengers, which Bezos looks to capitalise on for space tourism, a commercial opportunity most private space agencies are looking at.

It is also building a reusable rocket – Glenn, named after John Glenn, the first American to orbit the earth — which can carry payloads of as much as 45 tonnes in low earth orbit.

Bezos’ aim, however, is to land on the Moon. His Blue Moon lander can deliver large infrastructure payloads with high accuracy to pre-position systems for future missions. The larger variant of Blue Moon has been designed to land a vehicle that will allow the United States to return to the Moon by 2024.

Robotics

Image Source: Jeff Bezos/Twitter

Amazon’s take on robotics is grounds-up.

The company has been part of an open-source network that is developing ROS 2 or Robot Operating System 2, which will be commercial-grade, secure, hardened and peer-reviewed in order to make it easier for developers to build robots.

“There is an incredible amount of promise and potential in robotics, but if you look at what a robot developer has to do to get things up and running, it’s an incredible amount of work,” said Roger Barga, general manager, AWS Robotics and Autonomous Services, at Amazon Web Services.

Apart from building the software that robots will run on, AWS is also making tools that will help developers simulate robots virtually before deploying them on the ground, gather data to run analytics on the cloud and even manage a fleet of robots.

While AWS will largely build tools for developers, as capabilities such as autonomous navigation become commonplace, the company could look to build them in-house and offer them as a service to robot developers, Barga said.

With the advent of 5G technology, more of the processing capabilities of robots will be offloaded to the cloud, making them smarter and giving them real-time analytics capabilities to do a better job. For India, robot builders will be able to get into the business far more easily, having all the tools on access, overcoming the barrier of a lack of fundamental research in robotics.

Enterprise Technology

AWS might be a behemoth in the cloud computing space, but cloud still makes up just 3% of all IT in the world. The rest remains on-premise. While a lot will migrate to the cloud, some will not. In order to get into the action in the on-premise market, Amazon has innovated on services that run on a customer’s data centre, offering capabilities as if the data is stored on the cloud.

With Outposts, which was announced last month, AWS infrastructure, AWS services, APIs, and tools will be able to run on a customer’s data centre.

Essentially, this will allow enterprises to run services on data housed within their own data centres, just like how they would if it had been stored on AWS.

The other big problem that AWS is looking to solve is not having its own data centres close enough to customers who require extremely low-latency computing. For this, the company has introduced a new service called Local Zones, where it deploys own hardware closer to a large population, industry, and IT centre where no AWS Region exists today.

Both these new services from AWS could be valuable in India given the lower reach of cloud computing among enterprises as well as stricter data localisation requirements.

Artificial Intelligence/Machine learning

Amazon is moving up the value chain in offering services backed by artificial intelligence and machine learning to automate repetitive tasks done by human beings.

Enterprise customers will simply be able to buy into these services with minimal customisation and without a large data science and artificial intelligence team.

In December, AWS launched its Fraud Detector service that makes it easy to identify potentially fraudulent activity online, such as payment fraud and creation of fake accounts. Even large banks in India have struggled to put together teams to build machine learning models for fraud detection, but with such a service they can train their systems easily.

Code Guru is another service that uses machine learning to do code reviews and spit out application performance recommendations, giving specific recommendations to fix code. Today, this is largely done manually, with several non-technology companies struggling to build great software for themselves due to bad code.

Transcribe Medical is a service that uses Amazon’s voice technology to create accurate transcriptions from medical consultations between patients and physicians. Medical transcription as a service is a big industry in India, and India’s IT service giants hire thousands to review code. These services are expected to replace mundane manual tasks, freeing up resources for sophisticated tasks, and could lead to disruption.